The Risks of a Monopoly in Loan Settlement: Why the Market Needs Competition

February 27, 2025

How to be “Named Agent” without the headache of loan admin

October 6, 2025How to choose loan agency software ? A Buyer’s Guide for Modern Credit Markets

Loan agency software resource - buyer's guide

In today’s rapidly evolving credit markets, the role of the loan agent has become more complex than ever. How do you know which loan agency software is right for you?

With rising transaction volumes and growing demands from lenders and borrowers alike, legacy systems no longer cut it. Whether you’re a commercial bank, fund administrator, or private credit platform, choosing the right loan agency system is critical for operational efficiency, compliance, and client service.

At LedgerComm, we make the world’s most advanced loan agency technology. The loan agency platform for those who refuse to compromise.

Here’s how to choose the platform that’s right for you.

1. Define Your Needs Based on Your Role in the Market

Not all loan administrators are created equal. Even who the agent is has become a blurred line. Sometimes the agent is the lender, leading to another level of sophisticated access requirements.

Start by assessing:

- Are you an administrative agent, a sub agent, a collateral agent, or a facility agent?

- Are you a credit fund who needs to play the role of lender and agent – a named agent?

- Do you service bilateral loans, syndicated loans, or NAV loans?

- How sophisticated and data hungry are your borrowers/lenders?

- Do you need your loan agency software to link to data rooms & settlement systems?

2. Can your agency system scale with your ambitions?

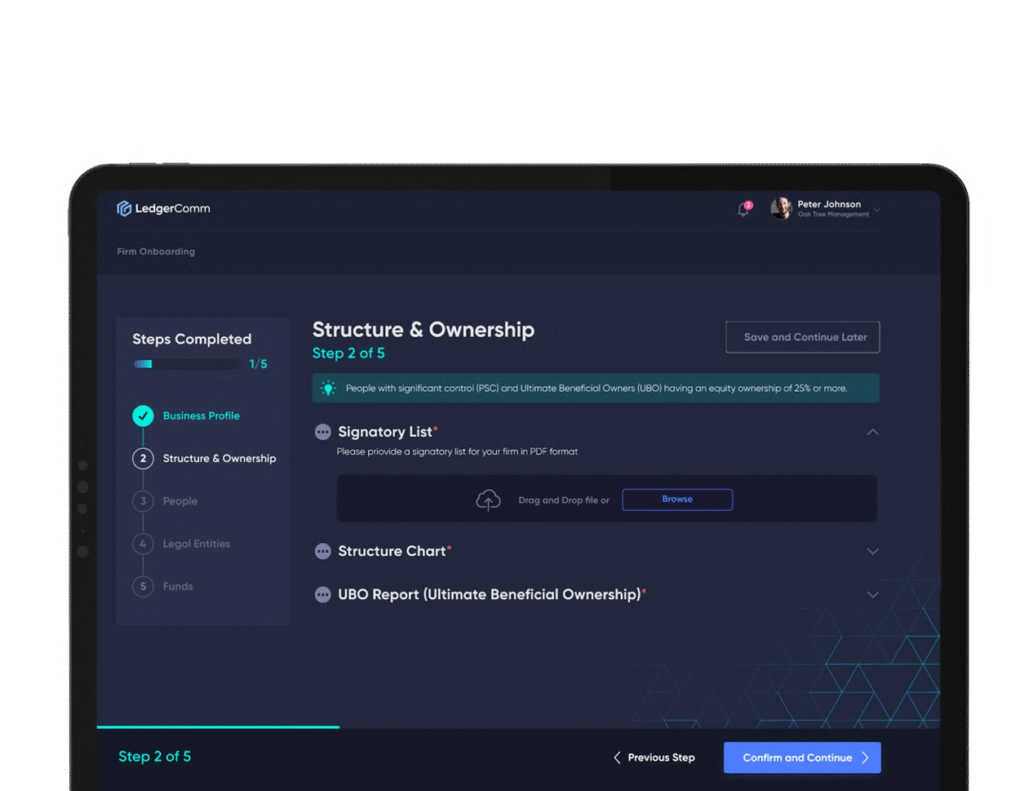

How much horsepower does your agency software give your firm? Do you want to start winning bigger agency mandates? The holy grail of loan agency is running syndications with 100’s of lenders. This comes with a significant KYC and onboarding burden. Some agents don’t even pitch for big deals for fear of not being able to handle the volume of admin.

- How future proof is your tech?

- Does it differentiate your firm from other agents?

- Can you scale your offering without having to add significant headcount?

- Does the platform offer STP trade processing? (low touch is better for big deals)

3. Demand access for all participants to your deals

The agent can be a time and information bottleneck when borrowers and lenders need data quickly. Choose a system that allows lenders, borrowers and PE sponsors to login, submit data for approval and get what they need when they want it.

- Does the system have a lender portal? (who wants to call for interest notices)

- Can lenders upload new SSI’s on each fund profile?

- Can borrowers load up covenants & key documents directly?

- Can borrowers access lender lists, previous coupon payments and KYC records?

- Can data be sent digitally to CLO or fund admin to avoid length rekeying of data?

Agents significantly lower their business risk if clients are responsible for data input of key tax and SSI information.

4. Prioritize End-to-End Workflow Coverage

A modern loan agency system should do more than just track payments. Look for platforms that integrate:

- Origination and onboarding workflows (including KYC)

- KYC document trackers & reminders (Tax ID’s UBO & PSC refresh capabilities)

- Transaction lifecycle management (interest rate resets, notices, fees)

- Loan trading and settlement integration (assignment agreements, lender consents)

- Document repository– data rooms for all loan documents

- Cash management and reconciliation

- Audit trails and reporting for regulators and investors

Fragmented tools increase risk. Look for systems that offer an integrated approach.

5. Prioritize User Experience — It Shouldn’t Feel Like 2003

Legacy loan platforms often look like legacy ERP systems. A modern system should offer:

- An intuitive interface for both junior and senior users

- Minimal training requirement to get started (Great UX is the backbone of any good tech)

- Clear workflows and dashboards tailored to each user role

6. Ensure Flexibility for Complex Deal Structures

Today’s deals involve bespoke waterfalls, multi-currency tranches, toggles, PIK interest, and complex amendment processes. Your system must handle:

- Custom payment waterfalls

- Transfer restrictions (e.g. distressed investor blocks)

- Delayed fee structures or complex RCF triggers ?

- Dynamic permissioned lenders capabilities

Ask vendors how their platform supports real-world edge cases—not just LSTA or LMA templates.

7. Permissioned lender lists

Sponsors have Permissioned lender lists for a reason; they are not going away. Getting a permissioned lender wrong can be a big risk for an agent. Can the system manage lists dynamically?

- Lender access to Permissioned lender lists

- Can sponsors adjust lists themselves?

- How are you, the agent, derisked by technology? (allowing Sponsor to control lists directly)

- Can the system accurately differentiate a distressed fund & CLO under the same manager?

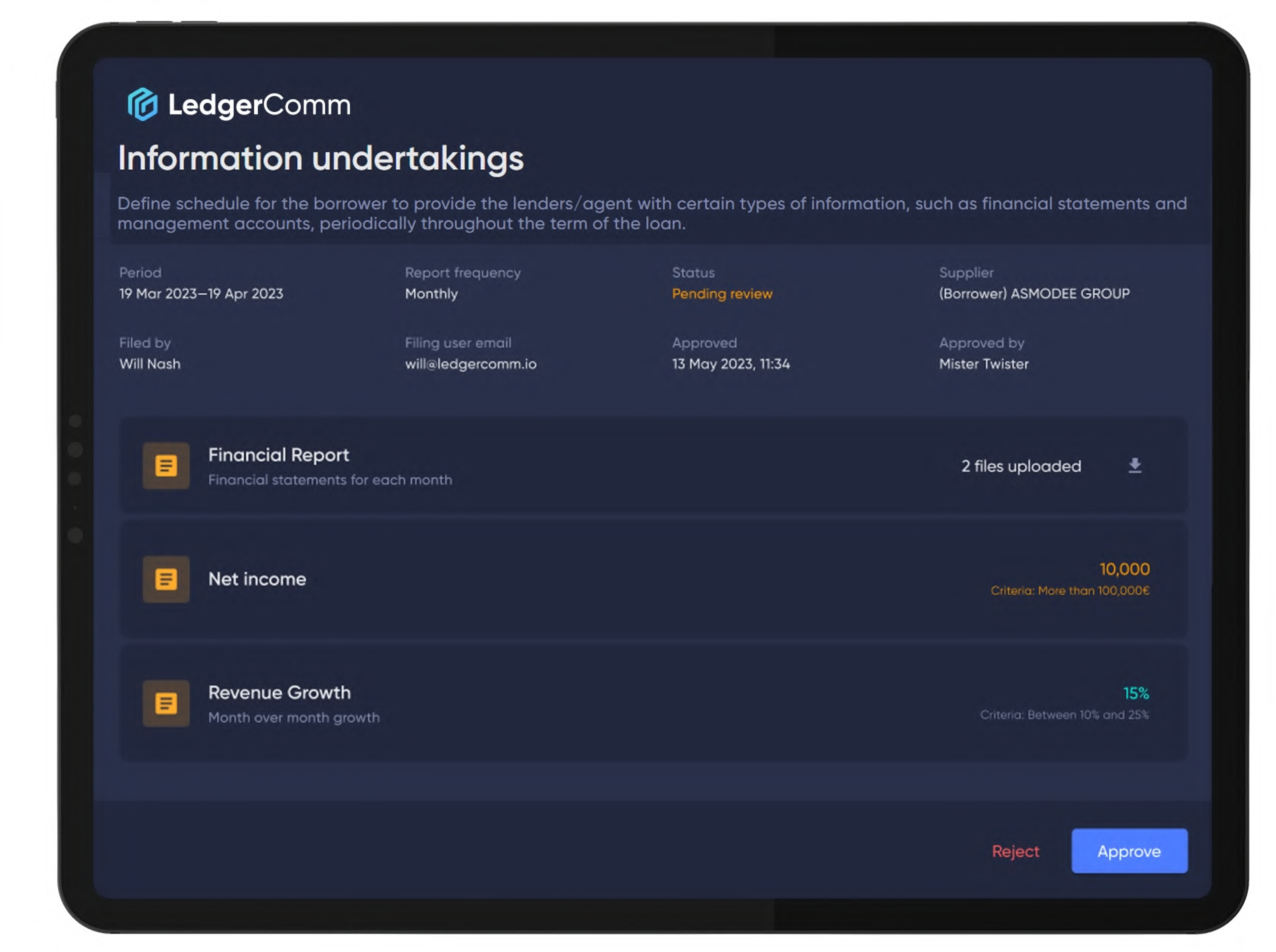

8. Evaluate Automation and Exception Management

Manual processes are error-prone and expensive. Ask vendors:

- What processes are automated (e.g., rate setting, accruals, notices, KYC tracking)?

- How does the system flag exceptions or manual interventions?

- Can rules be configured for delegation or auto-approvals?

- Can you set bespoke criteria for covenant monitoring?

- Are borrowers prevented from executing unauthorised drawdowns?

The best systems reduce noise and surface only what requires human input.

9. Check Regulatory Compliance and Security Standards

Given your role as a fiduciary, your platform must meet the highest standards. Verify:

- ISO 27001, SOC 2, or equivalent certifications

- Full audit logs and change tracking

- Compliance with data protection laws (e.g., GDPR, CCPA)

- Support for user-level access controls and document permissions

10. Amendments and restructurings

Amending a large deal with 100’s of lenders can be an all-consuming effort. Integration of settlement platforms and digital voting tools will mean you can run large restructurings without having to add significant headcount.

- Does it support digital voting?

- Can you set voting thresholds or define excluded lenders? (Sponsor affiliate, defaulting lenders etc?)

- Can the voting tool feed directly into a new up or downsized facility?

- What’s the vendor’s roadmap for future product expansion?

The more integrated the system the less work it will be for you and your team to service high profile clients in periods of stress.

11. Understand Onboarding and Support Requirements

IT transformation can be expensive. Ai is bringing that barrier down. The biggest obstacle to value for a firm when adopting new tech is poor onboarding. Ask:

- What’s the typical time-to-value?

- Can the system ingest existing deals and documents efficiently (AI tools help)?

- Does the vendor provide white-glove support or just tech documentation?

The goal is not just software—it’s transformation.

12. Request a Demonstration Using Your Actual Data

Generic demos are easy. A serious vendor should:

- Run a sandbox trial using anonymized versions of your real deals

- Demonstrate a complete deal lifecycle—from issuance to transfer to exit

- Show how exceptions and errors are handled in practice

13. Price Based on Value, Not Just Features

Sticker prices alone can be misleading. Consider:

- How many products are you getting in 1 system?

- Total cost of ownership over 3-5 years

- Admin headcount savings via automation

- Reduced error and compliance risk

- Improved client experience and reputation

- Does the vendor offer a starter pack for younger firms?

Many vendors offer tiered pricing—ask for modular options that align with your current needs and scale later.

Conclusion

Choosing a loan agency system is more than a software decision—it’s a strategic one. A well-implemented platform can transform your operations, reduce liability, and give you a competitive edge in a crowded market. Automation can keep your operating margins high and reduce key man risk.

Take the time to define your requirements, test the system’s depth, and ensure your provider is a true long-term partner with a clear roadmap of how they are going to deliver value to you and your client base.