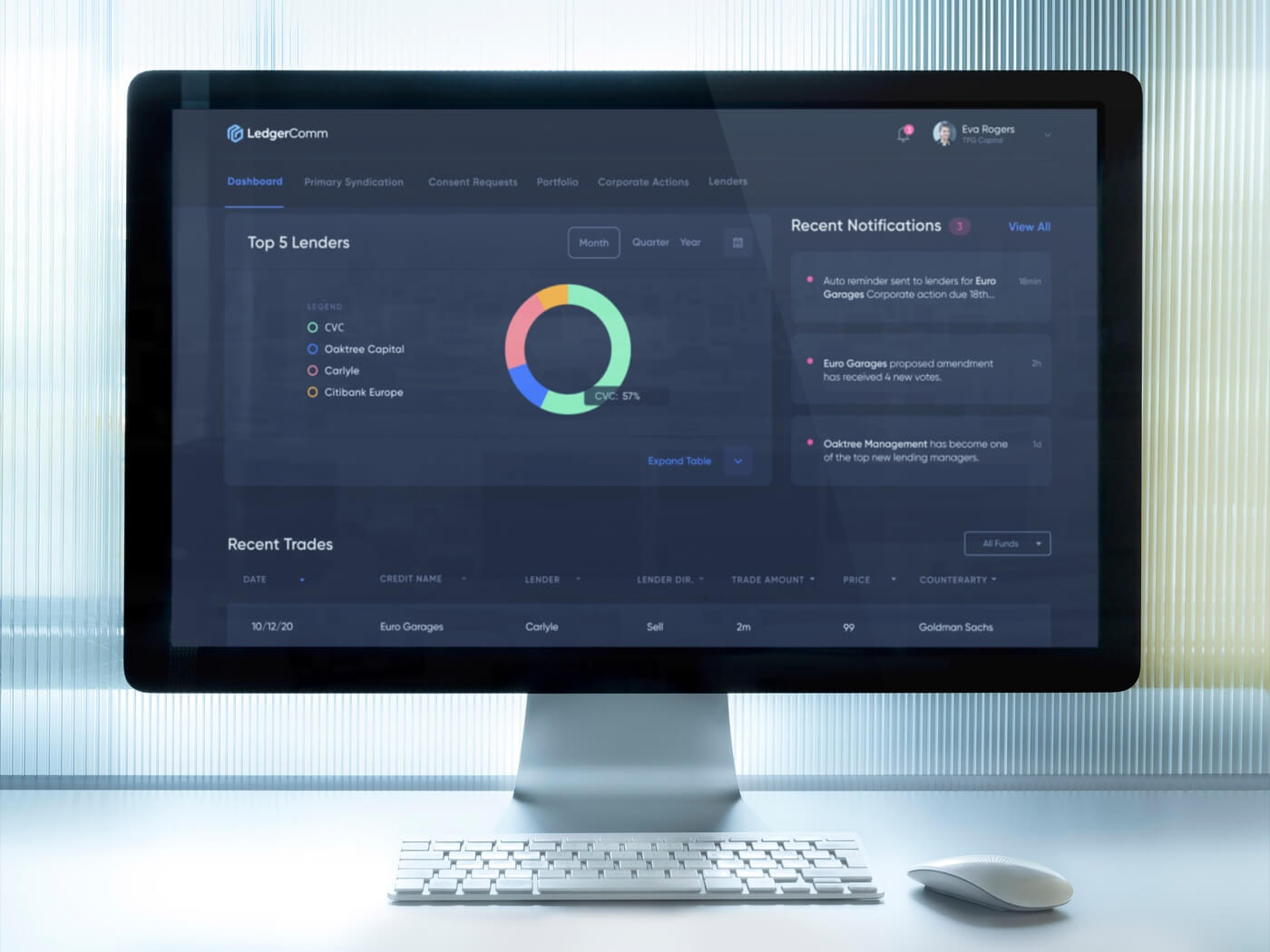

Loan software that connects front, middle and back office users

How are we different?

The loan market currently doesn't have an end to end system that takes trades from execution to settlement. So we decided to build one.

We provide all traditional agency functions required in loan transactions but with a settlement platform that allows straight through processing (STP) of trades.

Our complete solution covers pre-trade matching, trade execution and confirmation all the way through to settlement. With everything on one platform we allow clients to close loan trades quickly with minimal effort.

Simple, automated trade execution and settlement, delivers a low touch, tech enabled platform that customers can trust.

"A faster settlement window would reduce the difference between loans and bonds. Investors might be attracted to loans that are senior to bonds, but are currently put off by how long loan trades take to settle."

Source: 2019 European Commission’s report – ‘EU loan syndication and its impact on competition in credit markets.

Let's discuss your needs

We're always open for a chat.

Give us a call on +44 7899 901668, leave a message, or book a demo ›

LedgerComm Ltd

20 Eastbourne Terrace, London W2 6LA, United Kingdom