Amend & Extend: “Snooze you’ve been extended” the new game in town

August 25, 2023

What we are building with AI

June 27, 2024Loan trading – The future’s not bright it’s dark pools………

In this article I cover how recent private credit syndications show the loan market can move very fast from a market maker only model to an all to all trading and potentially even dark pool trading. This requires high quality data to enable buyer to take risk from known counterparties with guaranteed delivery of product.

Private credit deals are demonstrating the ability of the market to adopt an all to all model quickly

Syndicated private credit…..

Oxymoron right ? Well not really. Old school Private Credit was all bilateral. Covid changed that for good. 2023 has seen a further evolution of the mega underwrite. Those with large underwriting capabilities can underwrite and distribute like banks do.

Consider the largest deal of the year a $5bn deal done for Finastra underwritten by 3 titans of the private credit world. This deal was then syndicated out to over 25 funds making it essentially a syndicated term loan. To get this done all the firms facing off against each other would have to go through a full KYC process on each other.

What works for Primary can work in Secondary markets

So if funds are sharing risk at Primary what is to stop this in Secondary markets? This is the start of a new kind of liquidity in loan markets that can be enabled by platforms that have the ability to process both KYC and data trade data.

Counterparty KYC built into your loan platform

- If lenders are able to share and review each other’s KYC data ahead of trading then you remove the need for a centralised clearing house.

- KYC and trading limits can be applied bilaterally to create a fully functioning all-to-all trading venue.

- Funds can trade between each other without disturbing the water and highlight the trade to market makers. To read more about the LedgerComm KYC solution click here

To read more about how our KYC social network operates click here

All to all + KYC = Dark pools

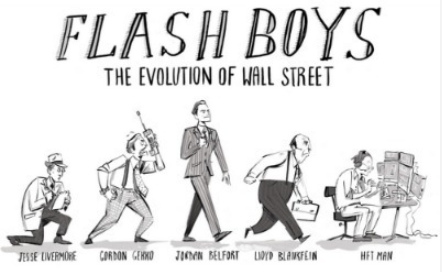

With customisable Counterparty KYC lists by manager and fund, we are able to see the genesis of the market to Flash Boys style of dark pool trading in loans that increases liquidity and preserves anonymity. The future is not bright its dark pools………

Will Nash is the Founder of LedgerComm.